What you need to know:

– Gold prices are on the rise in 2024, driven by factors like inflation, global uncertainties, and weakening US dollar.

– Gold is a traditional hedge against inflation and a safe investment option during uncertain times.

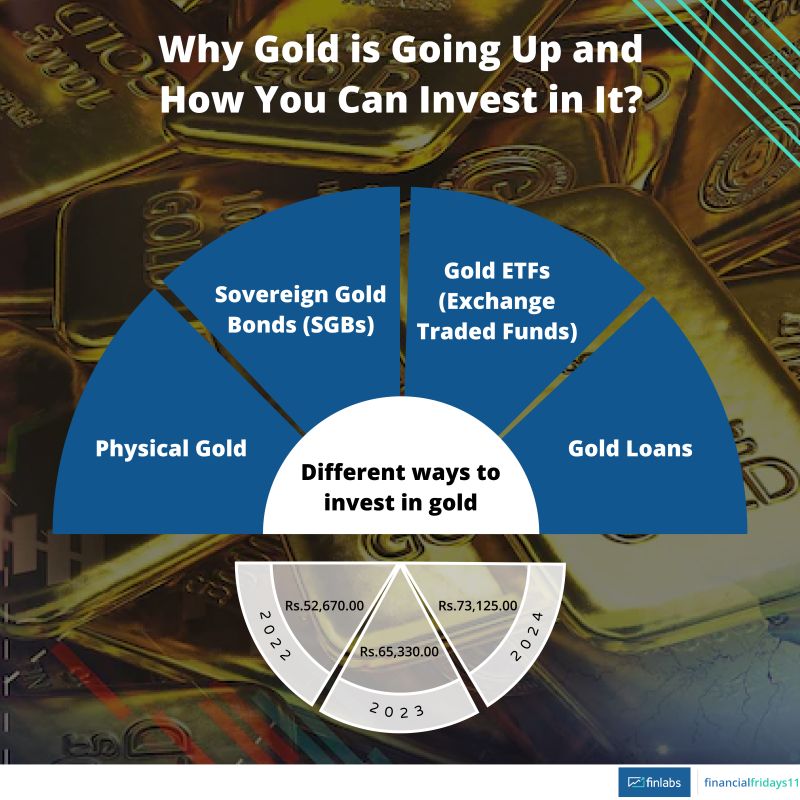

– There are several ways to invest in gold, including physical gold, Sovereign Gold Bonds (SGBs), Gold ETFs, and gold loans.

What does it mean for you?

– Gold can be a good addition to your investment portfolio, especially if you’re looking for a safe and stable option. It can help protect your wealth from inflation and market volatility.

Recommended action:

– Consider allocating a small portion (5-10%) of your portfolio to gold. You can invest in physical gold, SGBs, ETFs, or gold loans, depending on your preference and investment goals.

Here’s a quick breakdown of the different ways to invest in gold:

– Physical Gold: This is the traditional way of buying gold. However, it comes with drawbacks like storage risks, purity concerns, and GST on purchase.

– Sovereign Gold Bonds (SGBs): These are government-backed bonds that offer guaranteed interest income and tax benefits. They are a safe and convenient way to invest in gold.

– Gold ETFs (Exchange Traded Funds): These are similar to mutual funds, but they invest in physical gold. They offer ease of purchase and lower costs compared to physical gold.

– Gold Loans: You can take a loan from a bank or NBFC (non-banking finance company) using your gold ornaments as collateral. This can be a good way to access quick cash.

*source: https://lnkd.in/gfNSbKJF

The Herd Mentality in Investing

Ever felt the urge to follow the crowd when investing? That’s herd mentality at play. Let’s explore its impact with some eye-opening facts! A study by Barber and Odean found that individual investors who follow the herd tend to earn 3.5% less than the market annually. (Barber, B. M., & Odean, T. (2000). “Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors.” The Journal of Finance.) During the dot-com bubble, herd mentality led to massive investments in tech stocks, resulting in significant losses when the