One Seamless Workflow

No tab switching required, get more done faster with

everything in one place.

Platform

Manage multiple ARNs seamlessly without switching systems

or duplicating effort.

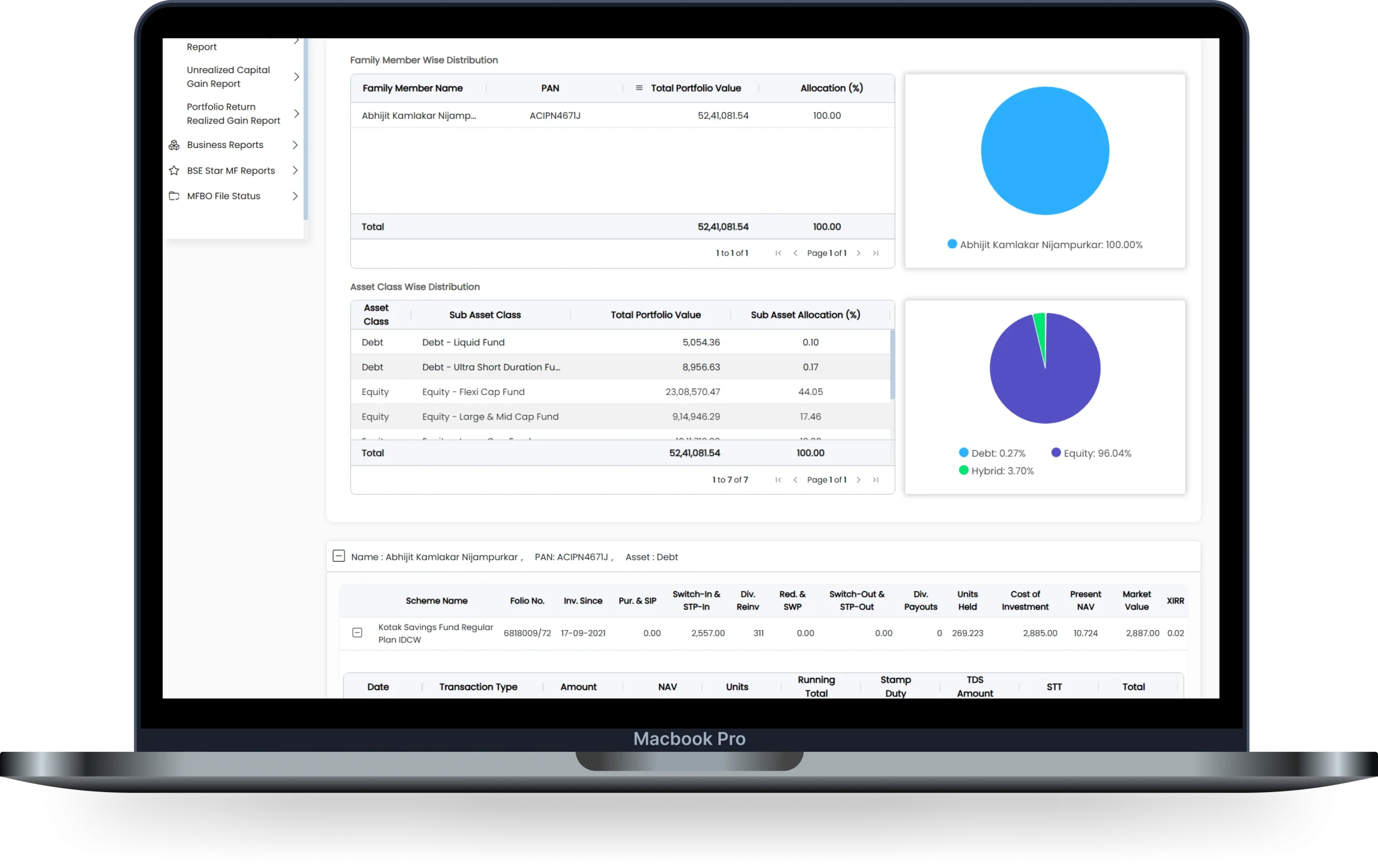

Reporting

From performance to compliance, Finexa brings

clarity with reports that speak your business

language.

Your Business

Dedicated Customer Service Manager who

understands your setup and priorities.

No tab switching required, get more done faster with everything in one place.

Manage multiple ARNs seamlessly without switching systems or duplicating effort.

From performance to compliance, Finexa brings clarity with reports that speak your business language.

Your Business

Dedicated Customer Service Manager who understands your setup and priorities.

Discover why financial professionals across

the industry trust Finexa

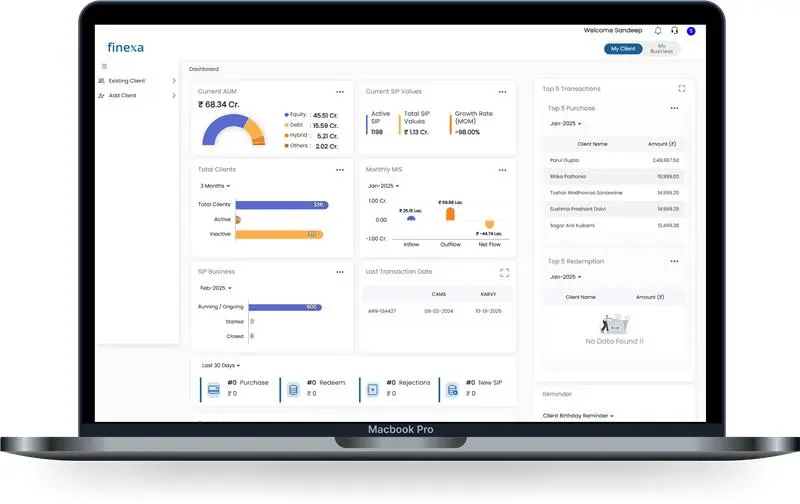

Finexa is an all-in-one Mutual Fund Distribution platform designed to simplify operations, enhance client engagement, and accelerate business growth. Available as a SaaS solution or enterprise version, it’s tailored to meet the needs of Mutual Fund Distributors (MFDs) and financial advisors.

With its modular design, Finexa is cost-effective and ensures a faster go-to-market. The platform automates key workflows such as reporting and portfolio tracking, centralizes client data, and streamlines back-office processes — all while supporting your brand identity.

By integrating advanced tools for financial planning and client management, Finexa empowers MFDs to deliver efficient, transparent, and high-quality investment experiences.

Key Features

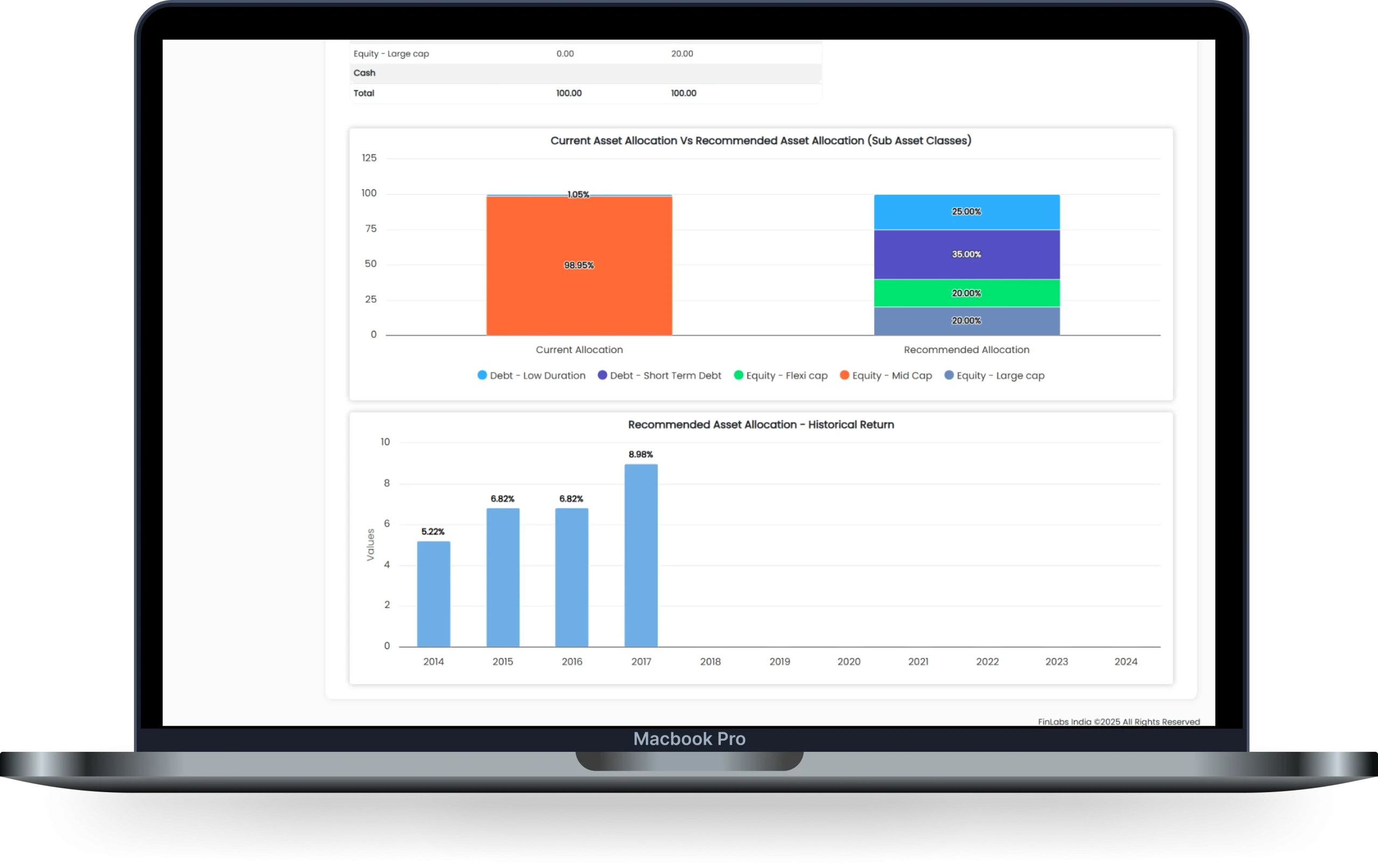

Designed with flexibility in mind, Finexa’s modular architecture adapts to your evolving financial needs. As your financial landscape changes, Finexa allows you to easily scale and integrate new tools. This ensures your financial management remains as dynamic and responsive as you are.

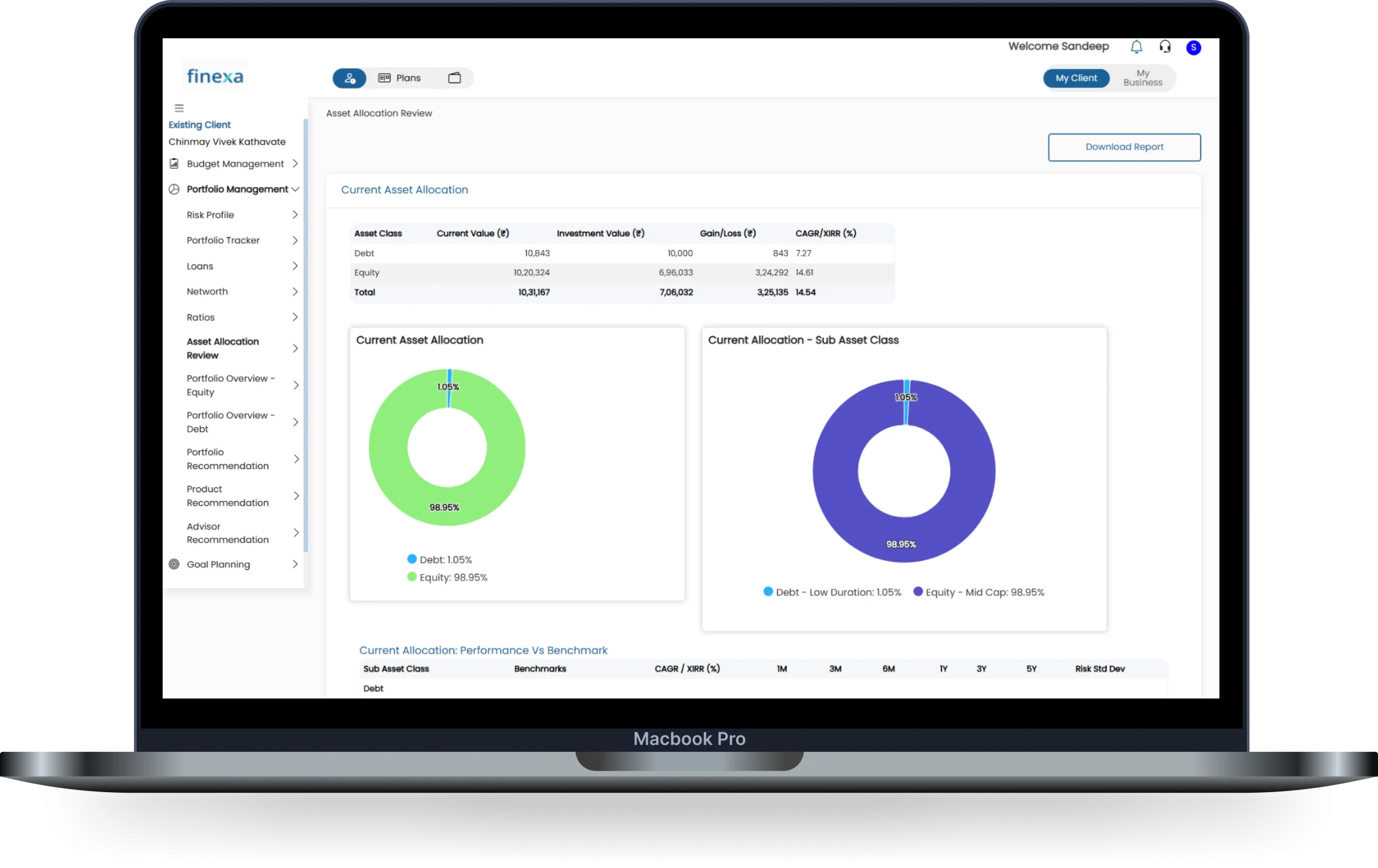

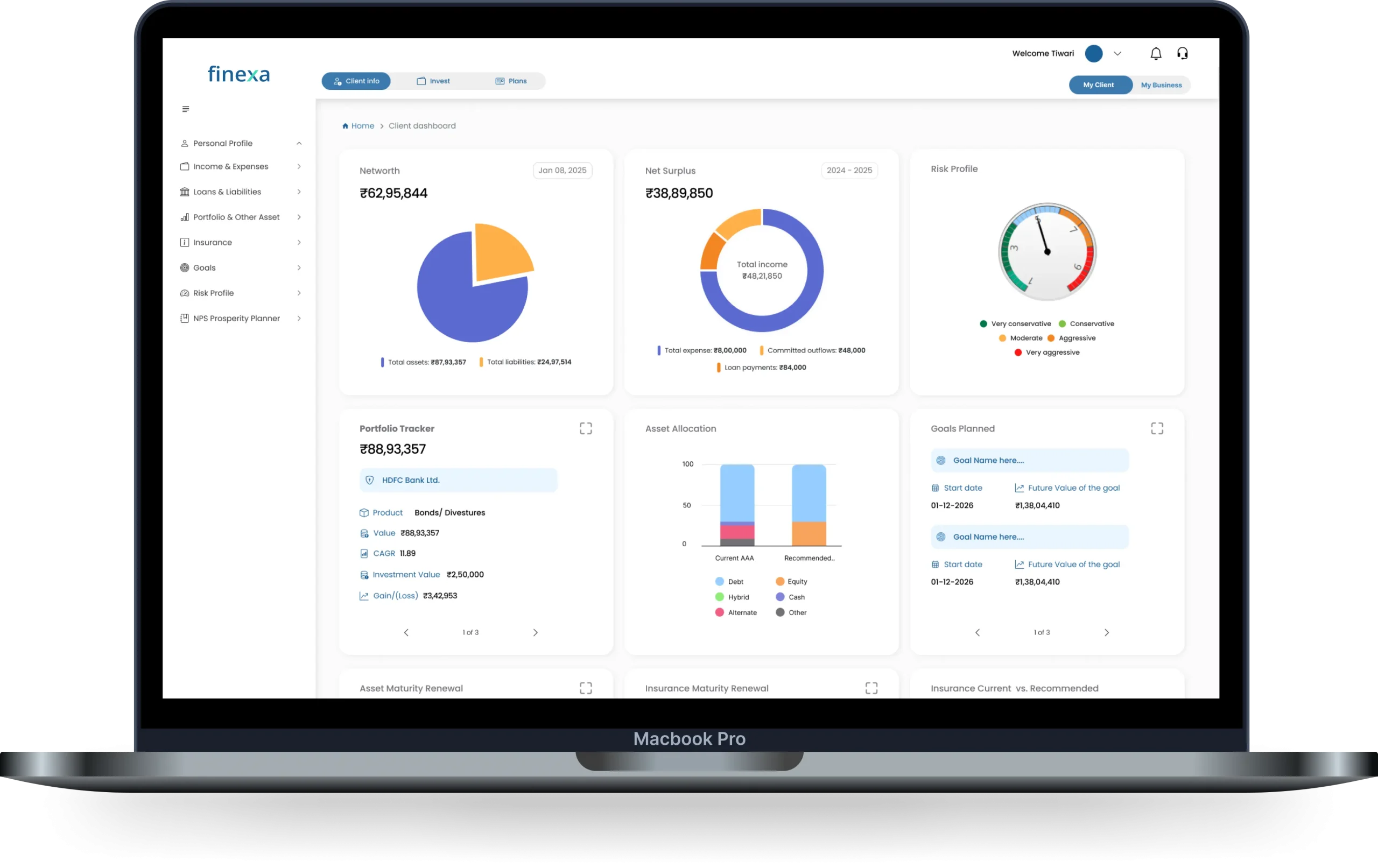

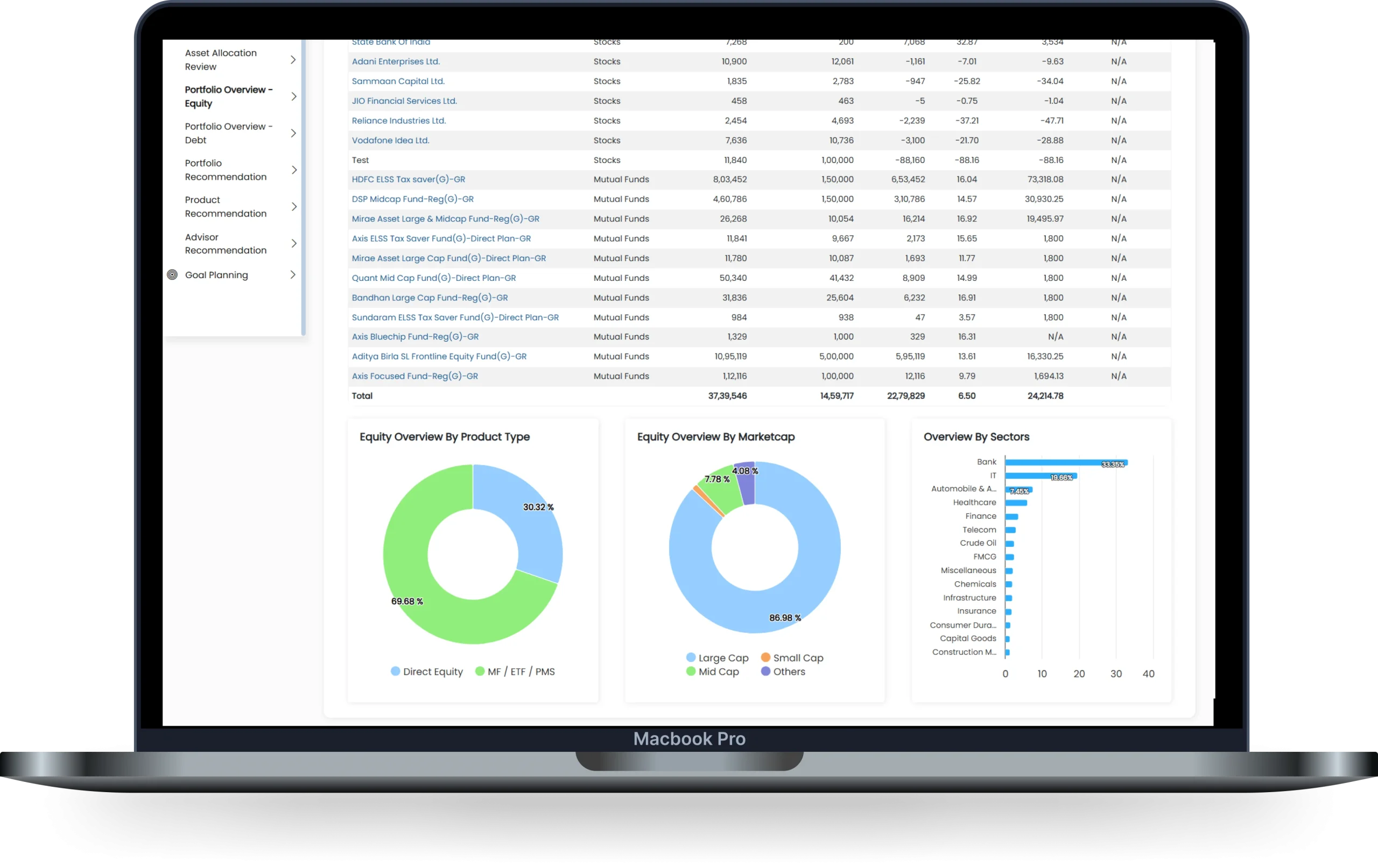

Portfolio Management & Analytics

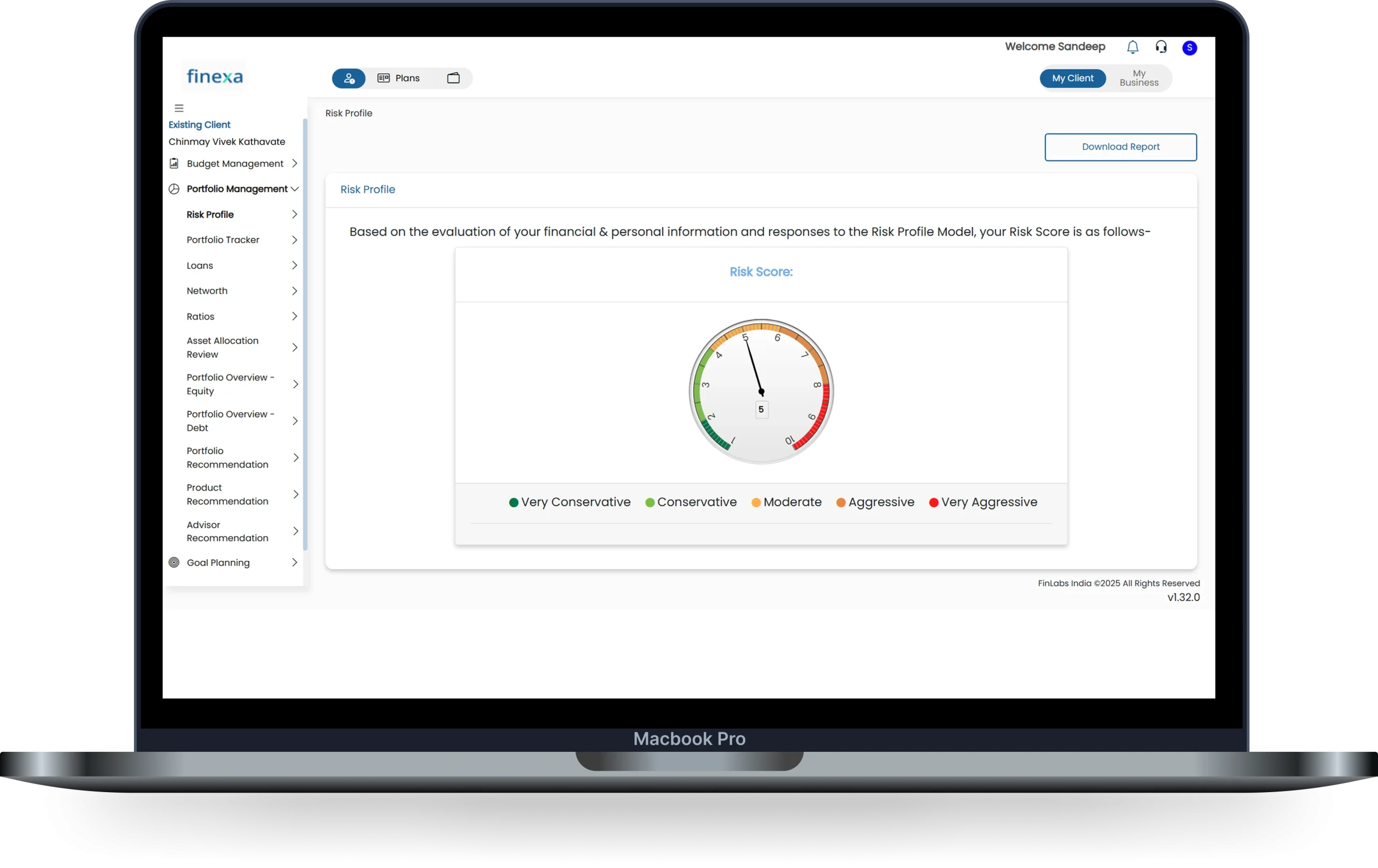

- Risk Profiling

- Comprehensive Customer Portfolio with Analytics

- Customer Portfolio Returns Calculation

- Comprehensive RM/Advisor Reports

Investment & Transaction Management

- Instant Digital Transaction (Lumpsum & Systematic)

- Seamless Order Processing via Interfacing to RTA & BSE Star

- RTA Interface for Reverse Feeds (Transaction, NAV & Income)

- Call Center-Assisted Transaction Execution & Queries

- RM-Assisted e-Risk Profiling & Transaction Execution

- Cart Facility

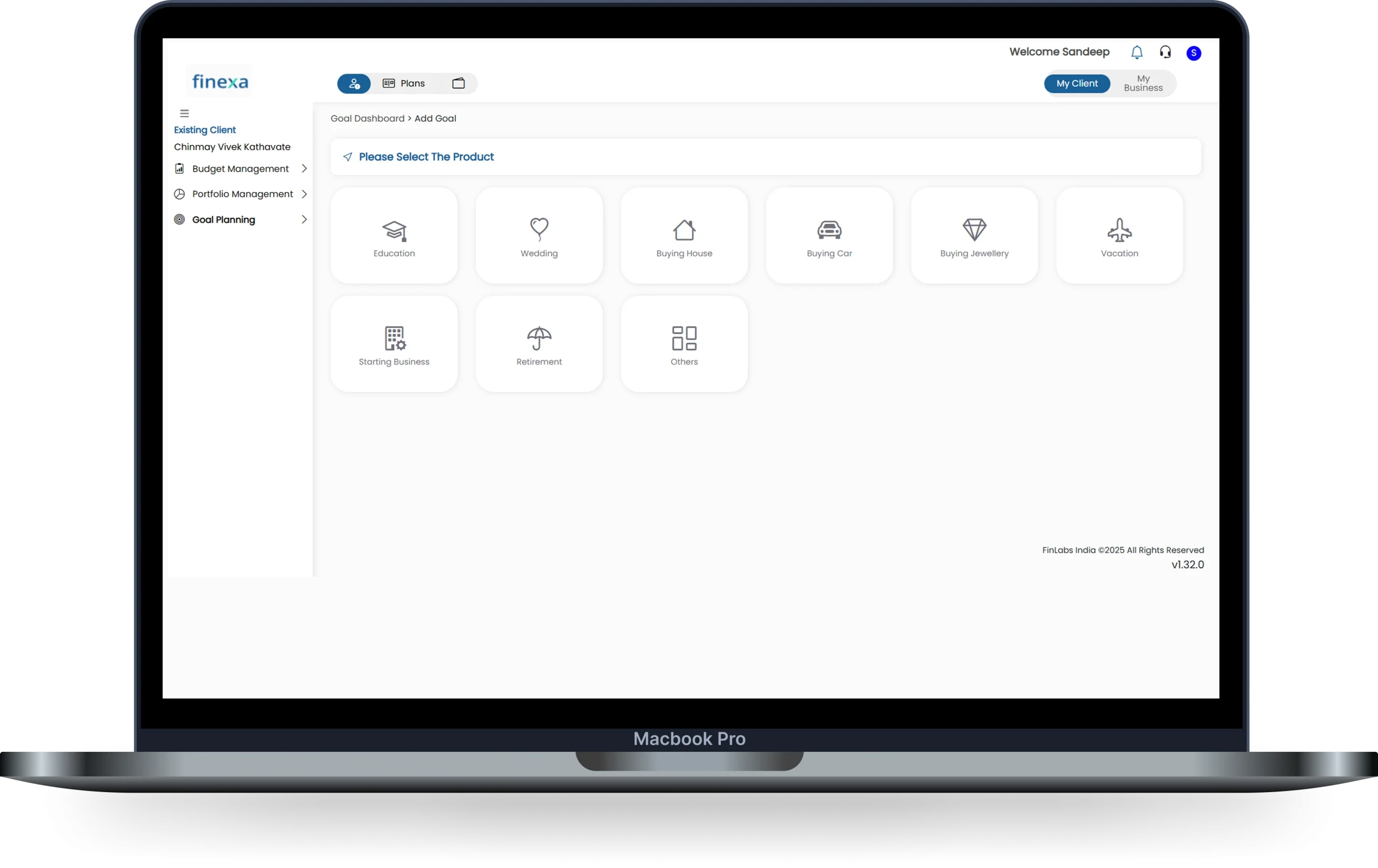

Customer & Advisor Experience

- Customer & Advisor Dashboard

- Goal Planning & Tracking

- RM-Assisted Customer Onboarding

- Responsive Designs

Integration & System Connectivity

- Integration with Various Data Service Providers

- Integration with Existing Core Systems

Reporting & Customization

- Comprehensive/Customizable Report Module

Business & Performance Reports

- Asset Under Management (AUM) Reports

- Active Systematic Reports

- YTD (Year-to-Date), MTD (Month-to-Date) Business Reports

- Detailed AUM Report

- Monthly Inflow-Outflow Report

Transaction & Investment Reports

- Transaction Report

- Current Portfolio Report

- Portfolio Since Inception

- STP & SWP Reports

- Dividend & SIP Report

Client & Investor Insights

- Client Creation/Edit Option

- Investor & Family Search

- Investor & Family Mapping

- Client-Wise & Scheme-Wise Holding Report

- Separate Portfolio Access for Branch/RM/Associate/Investors/Family

Brokerage & Capital Reports

- Brokerage Report – AMC, Transaction, Investor, Family, Branch, RM, and Sub-Broker

- Capital Gains (Tax Report)

Comprehensive Portfolio Reporting

- Master Portfolio (Includes MFs, Shares, PMS, FDs, Insurance, Bonds, NPS, and Other Assets)

Data & Portfolio Management

- Daily Data Update

- AUM Reconciliation

- Brokerage Data Update

- CAS Upload and Portfolio Creation

- Manual Entry of Mutual Fund Portfolios

- Investment Summary – Actual Investments Made Since Inception

User & Client Management

- User Creation

- Risk Profiling of Investors

- Client Portfolio Triggers

Financial Planning & Investment Tools

- Composite Financial Goal Planner Calculator

- Goal-Based Investment – SIP

- Goal-Based Investment – Lumpsum

- Goal Planning and Mapping with Existing Portfolio

- Investment Proposal – Lumpsum, SIP, STP, and SWP

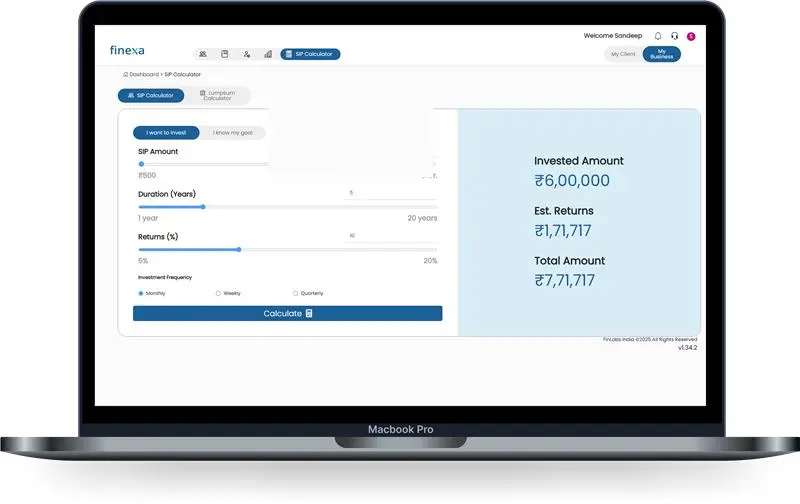

Calculators & Planning Tools

- Lumpsum Calculator

- SIP & SIP Top-Up Calculator

- Retirement Planning

![]() (Investor App)

(Investor App)

Ready to elevate your service?

- 24/7 Access

- Goal Monitoring

- Foster Loyalty

- Self-Client Onboarding

![]() (Investor App)

(Investor App)

Ready to elevate your service?

- 24/7 Access

- Goal Monitoring

- Foster Loyalty

- Self-Client Onboarding

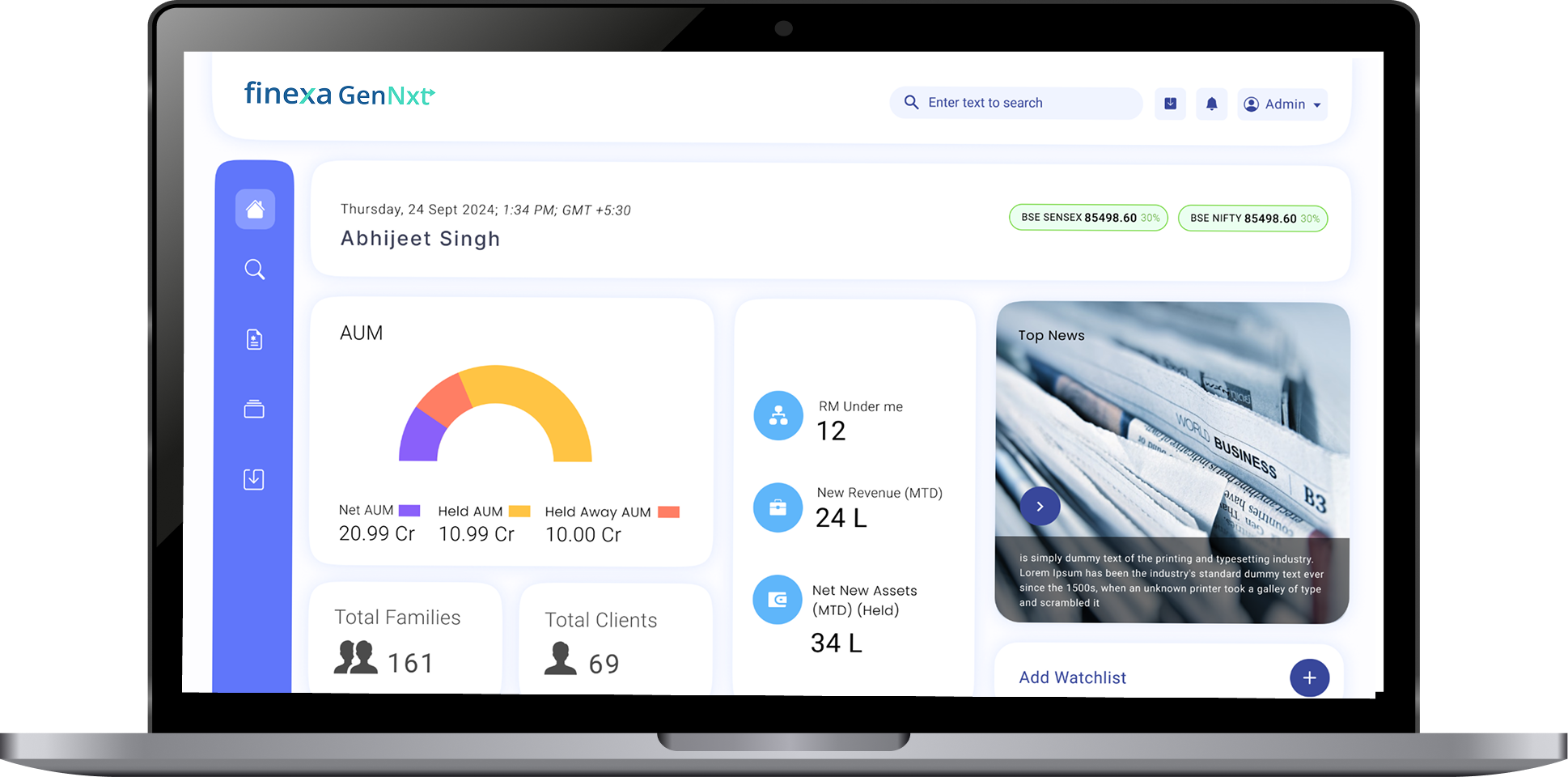

Empowering Wealth Management with Finexa GenNxt

Finexa GenNxt simplifies financial management by aggregating all assets on a single platform, offering advanced analytics and multi-asset reporting for deeper insights. With enterprise-grade security, it ensures safe and efficient financial oversight.

Related Topics

Finlabs Collaborates With LSEG (London Stock Exchange Group) To Drive Innovation In Wealth-Tech Solutions

We are excited to announce that Finlabs India Pvt. Ltd has partnered

Technology Is Becoming The Focus Of Wealth Management

One of the primary reasons for the extremely fast use and adaptation of technology in the wealth management industry is the addition of a whole new set of millennial customers who are young and tech-savvy.

How Technology Fuels Growth in Financial Advisory & Distribution

When it comes to technological changes, financial advisors no longer challenge against brokers, Robo advisors, and other advisory firms. People also judge their RIAs against the convenience and responsiveness set by multi billion companies such as Google, Amazon, and Uber.

Elevate your wealth management business with our innovative solutions

Finexa simplifies financial management with smart solutions. Accelerate digital onboarding for a seamless client experience. Enhance investment strategies with data-driven insights. Strengthen distributor and partner collaboration with an intuitive platform. Elevate investor engagement with a user-friendly app for effortless portfolio management.