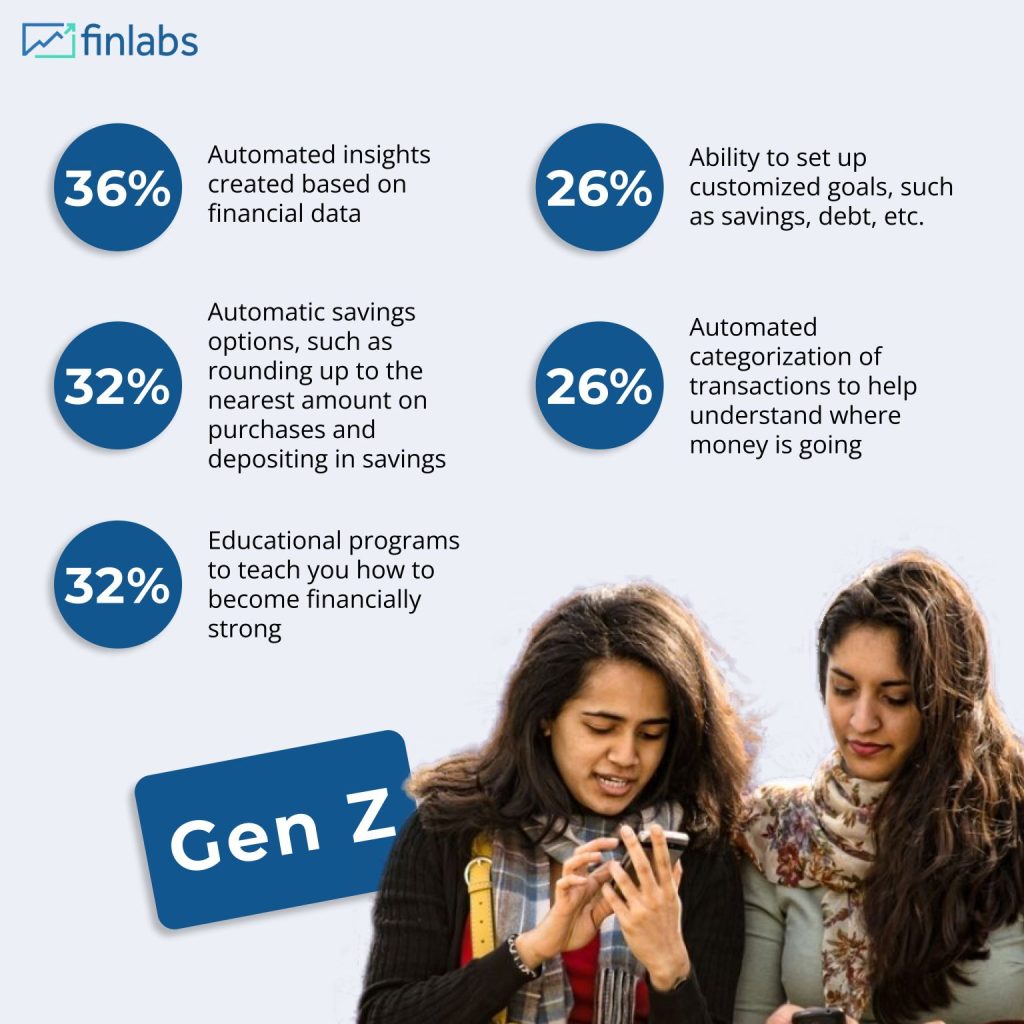

In today’s competitive landscape, financial institutions (FIs) can’t afford to be complacent. A recent study by MX* found that nearly half of Gen Z (45%) feel their financial providers fall short of their needs. This dissatisfaction isn’t limited to younger demographics – a quarter of all consumers share this sentiment.

(Refer to the infographic) These statistics paint a clear picture: consumers crave more. They want a financial partner, not just a place to park their money. They expect personalized experiences, proactive guidance, seamless connectivity, and data-driven insights.

Here’s where Finlabs comes in.

Our suite of highly customizable and modular financial technology solutions empowers Financial Institutions (FIs) to bridge this gap and deliver precisely what today’s consumers demand.

Imagine this:

A Customer receives personalized budgeting and savings recommendations based on their unique financial picture.

Customers can seamlessly aggregate all their financial accounts, regardless of institution, into a single, user-friendly platform. And even learn more about personal investing!

Read More: https://finlabsindia.org/bite-sized-learning-big-time-impact-the-power-of-microlearning/