The Lok Sabha elections in India are a monumental event that significantly influences various facets of life, including the economy and individual financial behavior. The election outcomes can lead to market volatility, reflecting investor sentiment and future economic expectations. This article explores how people’s behavior towards finances is affected post-elections, with a focus on market volatility and typical human responses during this period.

Understanding Market Volatility Post-Elections

Market volatility refers to the rapid and significant fluctuations in market prices. During election periods, markets often experience heightened volatility due to the uncertainty surrounding potential policy changes and their impact on the economy.

Key Factors Influencing Market Volatility Post-Elections:

- Policy Uncertainty: Anticipated changes in fiscal and monetary policies can lead to uncertainty, causing market swings.

- Investor Sentiment: Confidence or lack thereof in the newly elected government affects market stability.

- Economic Reforms: Proposed economic reforms can either stabilize or destabilize markets depending on their nature and perceived effectiveness.

- Global Factors: International market trends and geopolitical events also play a role in influencing market reactions.

Typical Human Behavior Towards Finances Post-Elections

Human behavior towards finances post-elections is shaped by a mix of optimism, caution, and reactionary measures based on election outcomes. Here’s a closer look at how different segments of the population typically respond:

1. Investors and Traders:

Initial Reaction: Immediately after the election results, there is often a knee-jerk reaction in the stock market. This can lead to short-term volatility as traders react to the news.

Strategic Adjustments: Investors may re-evaluate their portfolios, shifting towards sectors expected to benefit from the new government’s policies.

Risk Management: Increased focus on diversification to mitigate risks associated with policy changes.

2. General Public:

Spending Habits: Uncertainty can lead to cautious spending, with individuals preferring to save rather than spend on big-ticket items.

Investment Behavior: Preference for safer investment options like fixed deposits and government bonds during periods of high volatility.

Long-term Planning: Post-election, there might be a delay in long-term financial decisions such as buying property or starting new businesses until the economic direction becomes clearer.

3. Business Community:

Investment in Expansion: Businesses may hold off on expansion plans until there is more clarity on economic policies.

Hiring Practices: Employment decisions may be delayed or cautious, reflecting uncertainty in the business environment.

Market Strategy: Businesses might adapt their strategies based on the anticipated economic policies of the new government.

Case Study: 2019 Lok Sabha Elections

The 2019 Lok Sabha elections provide a clear example of these behaviours. Following the re-election of the incumbent government:

Stock Market Reaction: The markets initially surged, reflecting investor optimism about continuity in economic policies.

Sectoral Shifts: Investors showed increased interest in sectors like infrastructure, banking, and consumer goods, anticipating favourable policies.

Public Sentiment: General public sentiment was mixed, with some expressing optimism about economic stability and others remaining cautious about potential policy changes.

Conclusion

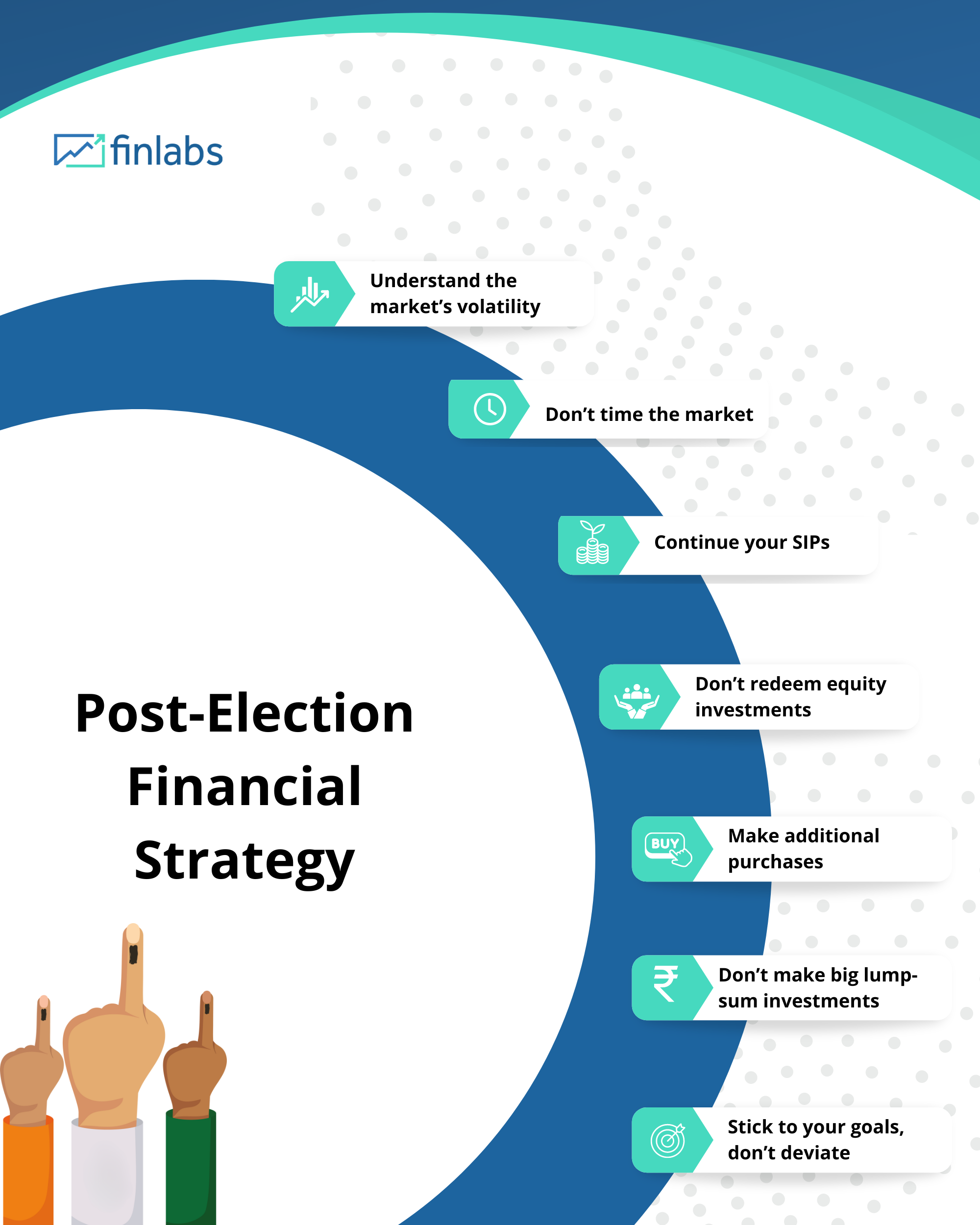

The aftermath of Lok Sabha elections in India brings about a period of adjustment and realignment in financial behaviours. Market volatility is a natural consequence of the uncertainty and new policy expectations that elections bring. Understanding these behaviours can help individuals and businesses better navigate the post-election financial landscape, making informed decisions that align with the new economic realities.

Read more- Adapt, Evolve, Excel: The Power of Continuous Learning in the Business World