The Cost of Not Knowing

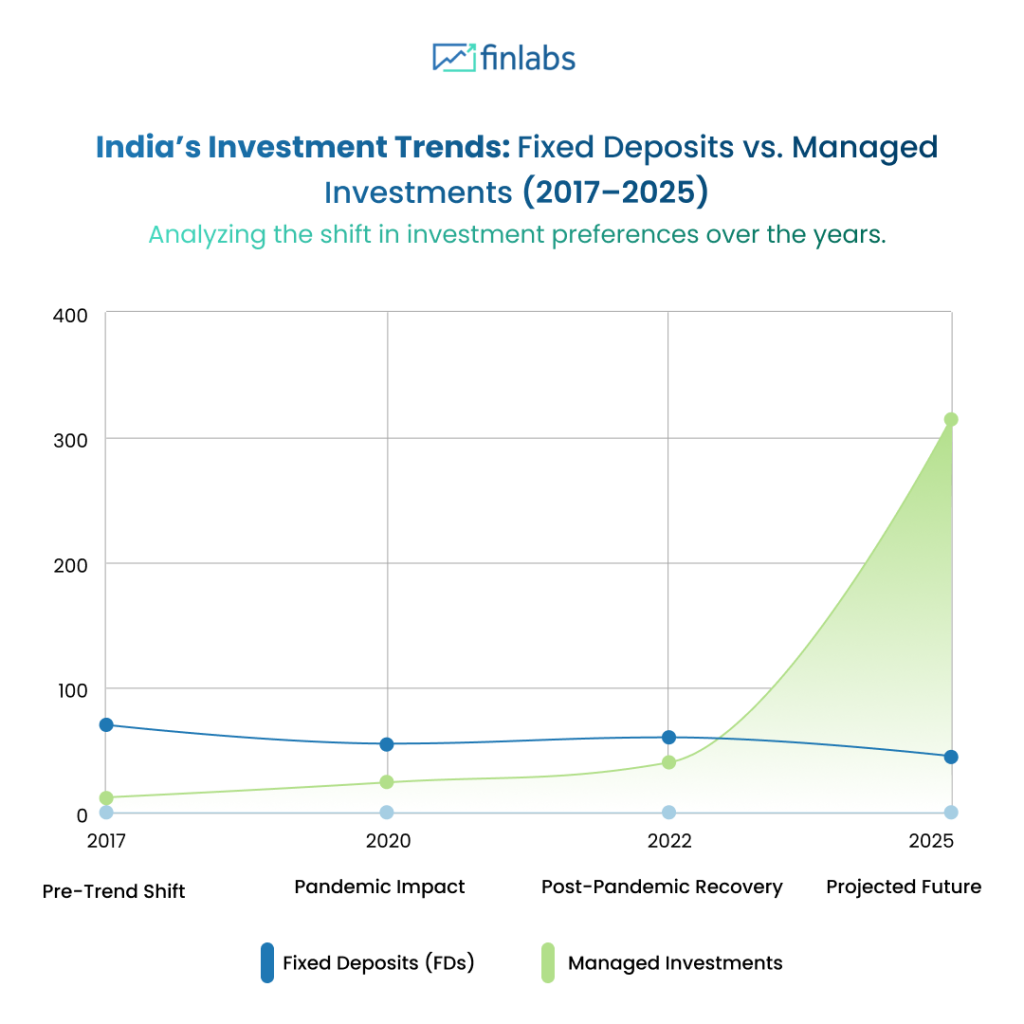

1. Why India’s Financial Literacy Gap Is Everyone’s Problem Every rupee you don’t understand could cost you more than you think.For individuals, the cost of not knowing shows up in small but painful ways: Overdraft fees Loan rejections Low credit scores Insurance that doesn’t cover what it should Missed investment opportunities But for India — […]