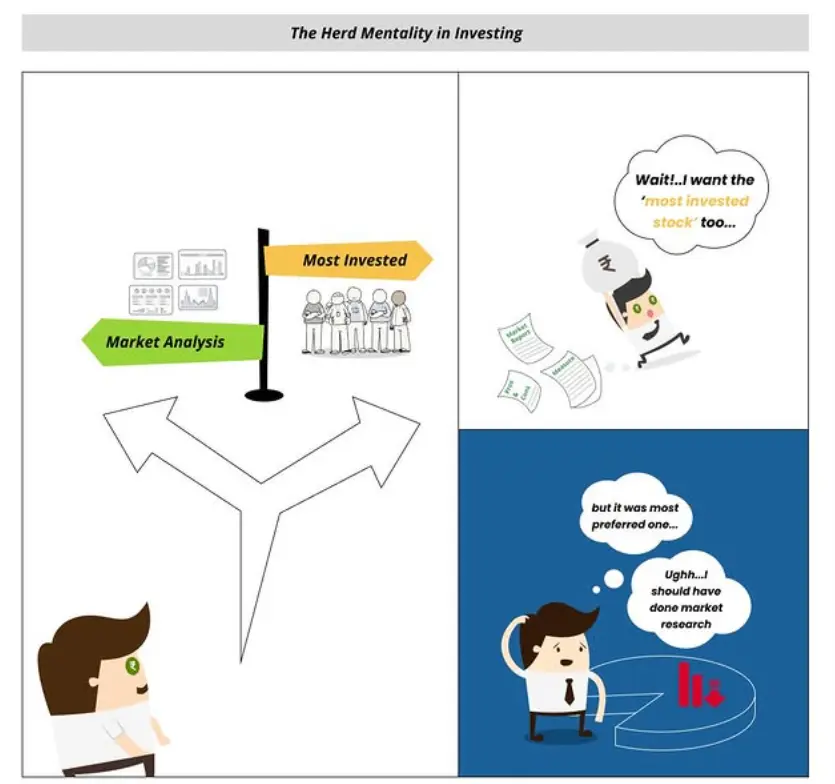

Ever felt the urge to follow the crowd when investing? That’s herd mentality at play. Let’s explore its impact with some eye-opening facts!

A study by Barber and Odean found that individual investors who follow the herd tend to earn 3.5% less than the market annually.

(Barber, B. M., & Odean, T. (2000). “Trading is Hazardous to Your Wealth: The Common Stock Investment Performance of Individual Investors.” The Journal of Finance.)

During the dot-com bubble, herd mentality led to massive investments in tech stocks, resulting in significant losses when the bubble burst.

Making independent, well-researched decisions can shield you from the pitfalls of herd mentality. Diversification and long-term planning are key.

Have you ever followed the herd in investing? Share your experiences!

Join us every Friday with #financialfridays11 for more insights into financial psychology.

The Influence of Overconfidence

Are you overconfident about your investment skills? You might not be alone. Overconfidence can skew our financial decisions. Check out this surprising stat! According to