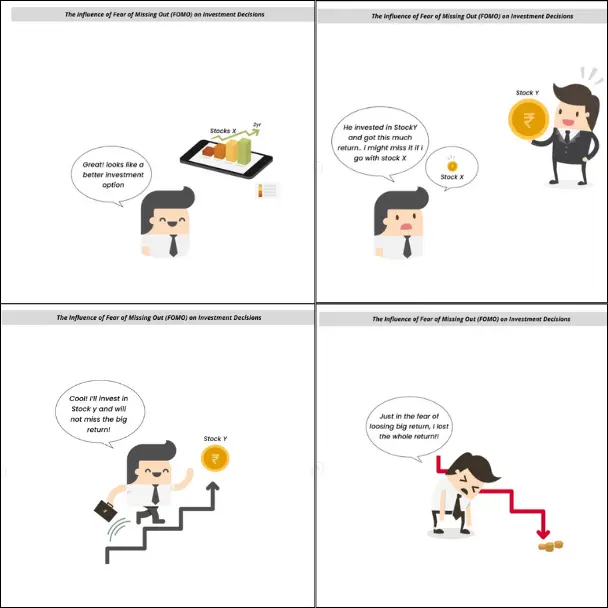

Making investment decisions based on FOMO?

Explore how the fear of missing out impacts your financial choices!

Fear of missing out (FOMO) is the anxiety that others are experiencing something desirable that you are not. While investing, this bias can lead to impulsive decisions to buy into trending assets or markets, driven by the fear of missing potential gains, rather than sound financial analysis.

Fact: FOMO can influence trading behavior, market sentiment, and asset price volatility, affecting investment outcomes over time.

Insight: By managing FOMO, investors can adopt a disciplined approach, conduct thorough research, and make decisions based on their own financial goals and risk tolerance.

Share your experiences with FOMO in investment decisions in the comments. Let’s explore more insights into behavioral psychology for smarter money management.

#FOMO #InvestmentDecisions #financialfriday #behavioralfinance #moneymindset

Follow #financialfridays11 for more tips on overcoming decision . 🤔 Share your story in the comments below! And don’t forget to check out our Risk Calculator to help you make confident financial decisions.