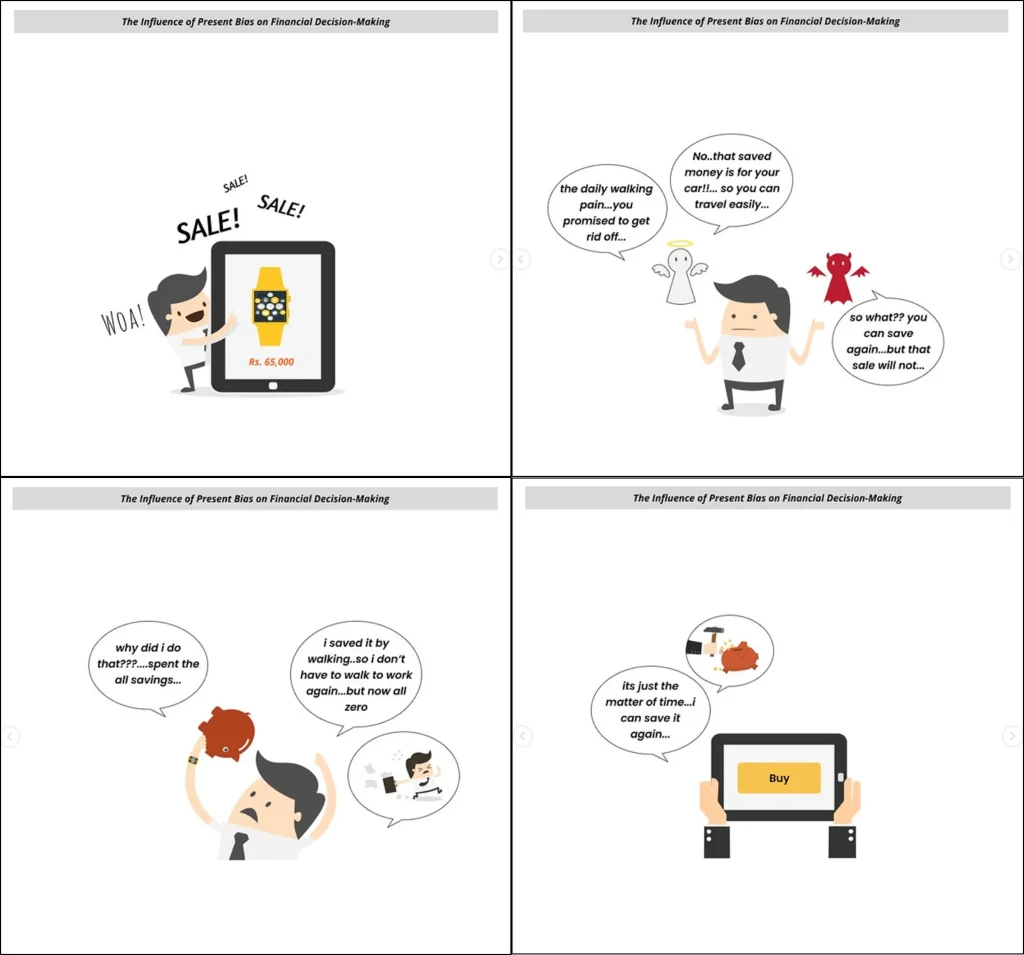

The Influence of Present Bias on Financial Decision-Making

Are short-term desires clouding your long-term financial goals? Explore the psychology of present bias today!

Present bias refers to the tendency of individuals to prioritize immediate rewards over long-term benefits, even when it may not be in their best interest. In finance, this bias can lead to overspending, neglecting savings, and making impulsive investment decisions.

Fact: Research shows that present bias can hinder wealth accumulation and retirement planning, as individuals may procrastinate on saving and investing for the future.

Insight: By understanding present bias, you can develop strategies to balance immediate gratification with long-term financial goals, such as setting up automated savings, creating financial milestones, and practicing mindfulness in spending decisions.

Share how present bias has influenced your financial decisions in the comments and join us in exploring more insights into behavioral psychology for smarter money management

#Finlabs #wealthmanagement #BehaviouralFinanceInsights #MindfulInvesting #FinancePsychology

Follow #financialfridays11 for more tips on overcoming decision .