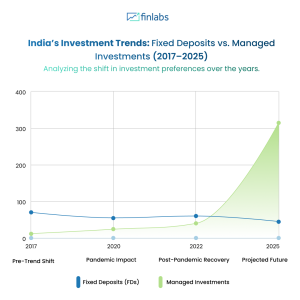

Elections can bring uncertainty to the markets, but your financial strategy doesn’t have to waver. In our latest blog, we delve into how people’s financial behaviours are influenced post-elections and offer actionable strategies to manage market volatility effectively.

Highlights:

– Understanding market volatility

– Why timing the market is risky

– Importance of continuing your SIPs

– Strategies for making additional purchases

– Staying committed to your long-term financial goals

Read More: https://finlabsindia.org/take-control-of-your-finances-the-benefits-of-digital-banking/