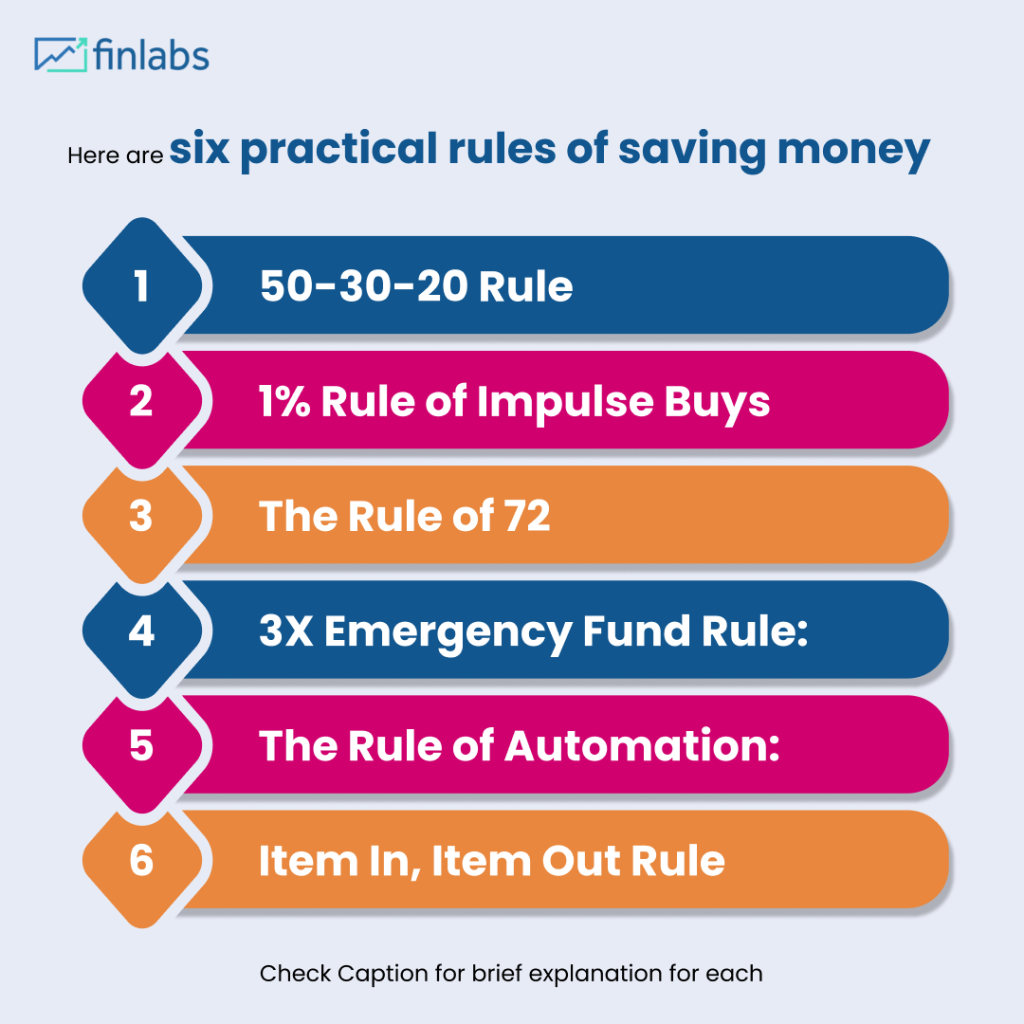

Financial Rules for Better Money Management

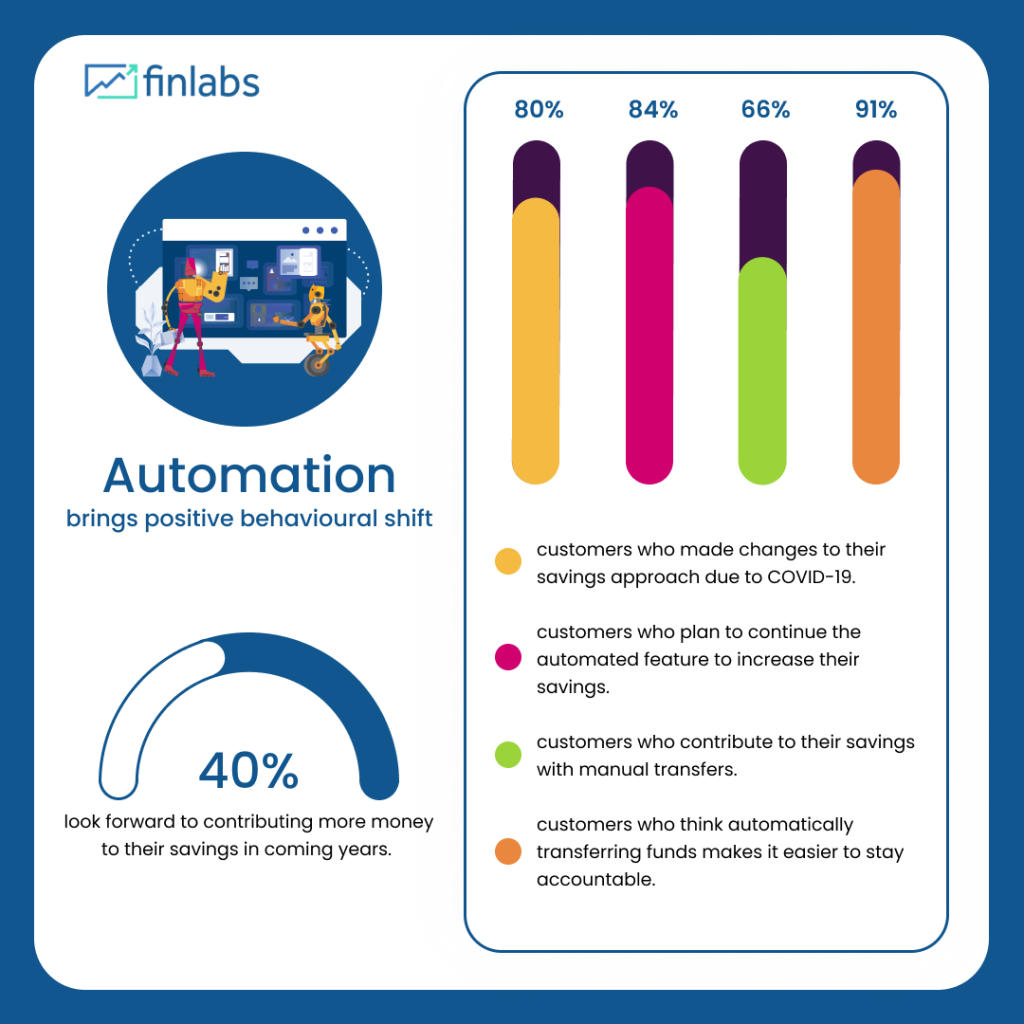

50-30-20 Rule:Allocate your after-tax income into three categories: 50% for needs (essentials like rent, groceries, and utilities), 30% for wants (entertainment, dining out), and 20% for savings and debt repayment. This simple framework helps balance spending and saving. 1% Rule of Impulse Buys:For any unplanned purchase that costs more than 1% of your annual income, […]

Financial Rules for Better Money Management Read More »